Case Study

NAVIGATING THE CURRENT CHANGES IN ENVIRONMENTAL DESIGN / DEVELOPMENT TAX LAW

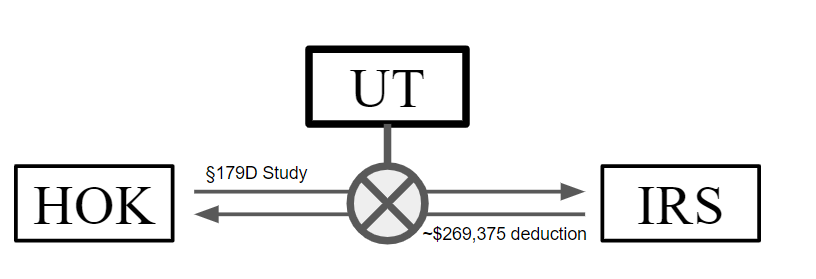

Understanding the IRC §179D Energy Efficient Commercial Building Deduction - HOK v. EE Case

The HOK v. EE case sheds light on the IRC §179D Energy Efficient Commercial Building Deduction. This landmark case provides valuable insights into the application of this deduction. One of the most intriguing aspects of this case is the conflict between Efficiency Energy, a consultant for UT, and Alliantgroup, a consultant for HOK. This contentious history played a pivotal role in shaping the nature of the EECBD deduction for everyone involved.

The Battle Line

In the HOK v. EE case, a significant point of contention revolved around UT’s intention to claim a portion of the IRC §179D value. Efficiency Energy (EE) believed that UT had the authority to demand that HOK disgorge a substantial part of the Energy Efficient Commercial Building Deduction (EECBD) in exchange for an assignment.

On the other hand, HOK, acting as the lead designer, maintained the position that UT could not withhold a valid EECBD assignment to a qualified party. This dispute underscores the complex legal and financial intricacies surrounding the IRC §179D deduction, with implications that extend beyond the case itself, making it a pivotal element in understanding the deduction’s dynamics.

The Right to Block

Ultimately, EE appeared victorious. The court refused to force UT to assign the deduction, and the nature of the deduction changed.

The basic debate radically shifted, and institutions suddenly viewed these deductions as an income opportunity, not for the designers, but for themselves.

This left designers in a tricky place; they either negotiated these rights early, or they faced a real threat of being cut out.

QUICK LINKS

- 6501 Navigation Suite M5

- Houston, TX 77090

- (832) 617-4401

- contact@davidcooleyandassociates.com