Seamless Integration

The Inflation Reduction Act

Smoothly Folding the §179D Deduction (EECBD) into Practice

The Benefits

The benefit of the EECBD is immense:

- $5.00 per square foot deduction.

- Transferable to designers.

As noted here, the deduction for a relatively modest building is transformative.

Calculating these benefits across an entire practice is likely to be more effective than any other tax strategy available.

The Plan

The EECBD is built on two key reports:

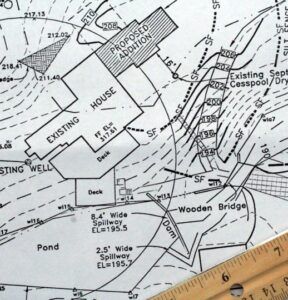

- Building Efficiency Study. A designer will develop a CAD model tested by specific software.

- Tax Compliance Study. A tax professional will prepare a report on the property, and how it qualifies.

While simple in concept, a lot rides on the accuracy of these reports. Both also rely on data and planning.

These are the key elements:

The Parties

As noted, three parties are named within the EECBD, each with different interests:

Designer: Architects / Designers are motivated to provide the highest design possible within the budget.

Labor: Laborers are interested in providing the most efficient means of production.

Owner: The owner’s primary concern is balancing costs with the building program.

These individuals are effectively tied to each other during the course of construction, which is already a charged and chaotic environment. The EECBD can compound this.

We are expert in handling these parties

The First Steps

The foremost issue is information. It is absolutely critical to know where the parties stand in regard to the EECBD requirements.

We quickly determine the landscape:

- Setting expectations. Initial discussions clarify all key issues with ownership, design, and labor.

- Administration. Distributing the responsibilities, with sufficient tools for enforcement, is essential.

- Boundaries. Building construction is an old field, with rigid conventions. We work within this framework everywhere possible.

- Assignments. The EECBD has absolute demands. It is essential that these assignments be made at inception.

Tools and Negotiations

There is no substitute here for experience. There are historically reasonable negotiation parameters that are industry-specific. Knowing them, what is negotiable, and often more importantly, what is non-negotiable, is essential.

Designers serve at the behest of the Owner, but they have certain major advantages regarding the EECBD. The designers are the greatest experts in their area, and trusted advisors.

Time

EECBDs require compliance from inception. Designers are the first party engaged, and have the greatest visibility through every stage. They are uniquely positioned to take it successfully.

The Trades

EECBDs require information from the trades. Designers interact directly with the trades, and are uniquely situated to capture this data.

Copyrights

The CAD drawing is the hub around which EECBD value is built. Legal rights for the drawing typically vest in the designer. It is critical to control how this is licensed / distributed.

Relationships

The greatest intangible is the designer’s institutional knowledge. We can help designers enforce the agreements, without damaging / delaying the project.

Take the First Step

The foremost issue is information. It is absolutely critical to know where the parties stand in regard to the EECBD requirements.

We quickly help you determine the landscape:

Setting expectations. Initial discussions clarify all key issues with ownership, design, and labor.

Administration. Distributing the responsibilities, with sufficient tools for enforcement, is essential.

Boundaries. Building construction is an old field, with rigid conventions. We work within this framework everywhere possible.

Assignments. The EECBD has absolute demands. It is essential that these assignments be made at inception.

How to Proceed

Taking an EECBD deduction takes careful planning. Starting early, having clear goals, and aligning interests with competencies, gives the greatest likelihood of success.